Note: Ginger Luke, the Founder of Ginger’s Pet Rescue, passed away on September 22, 2021. Our condolences go out to her friends and family.

Massive Salary Increase

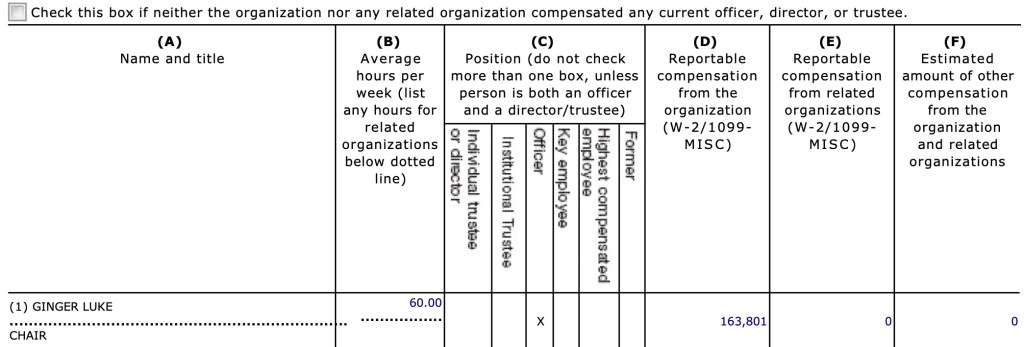

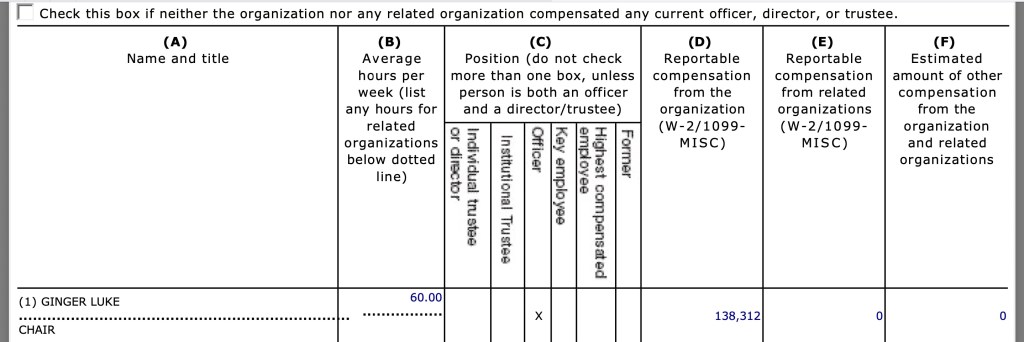

Recently I discovered that Ginger’s Pet Rescue in Seattle paid its founder Ginger Luke $138,312 in 2019 and $163,801 in 2020. The payments were astronomically higher than her salary for the previous few years.

I found this information on the publicly available tax forms the rescue submits to the Internal Revenue Service (IRS).

Here’s how much the rescue paid Ms. Luke from 2015 – 2020:

2015 $5200

2016 $35,600

2017 $18,900

2018 $19,200

2019 $138,312

2020 $163,801

From 2018 to 2019, her salary increased by 620%. It went up more than 18% the following year.

That’s quite an increase.

I don’t think we should expect people take a vow of poverty to run a charity, regardless of whether or not it saves animals, protects the environment, or helps impoverished families.

But their CEO salaries shouldn’t be excessive. They should be based on what similarly sized charities in the region doing the same work pay their CEOs.

And because charities are public organizations, the process for determining how much they pay their top employees should be transparent. In fact, as I note later, the IRS insists on it.

Salary Out of Line With Other Seattle Area Animal Rescues

To make a fair assessment of the increase in Ms. Luke’s salary, I Iooked at the salaries for the top executives at the Seattle Humane Society in Bellevue, Homeward Pet Adoption Center in Woodinville, The NOAH Center in Stanwood, and the Humane Society for Tacoma/Pierce County in Tacoma from 2015-2020.

I then checked the groups’ revenue to get an idea of the size of the organizations. I also looked at the percentage of average revenue their CEOs’ salaries represented.

This information came from the groups’ 990s, which are financial statements they must to submit to the IRS annually. Some of the groups hadn’t turned in their 990s for 2020 to the IRS yet so I didn’t have their information for that year.

Since her salary for 2019 and 2020 was such an outlier compared to 2015-2018, I averaged the data for those 2 years and compared it to the averages of the other groups for 2015-2019/2020.*

| ORGANIZATION | AVG CEO SALARY | AVG YEARLY REVENUE | CEO SALARY % OF INCOME |

| Ginger’s Pet Rescue | $151,057 | $970,933 | 15.7% |

| Homeward Pet Adoption Center | $88,465 | $1,982,850 | 4.5% |

| Humane Society for Tacoma/Pierce County | $163,001 | $7,181,550 | 2.3% |

| The NOAH Center | $90,277 | $3,192,726 | 2.8% |

| Seattle Humane Society | $162,297 | $12,401,892 | 1.3% |

Ms. Luke’s average salary for 2019-2020 represented more than 15% of the rescue’s average revenue during the same period. That’s a significantly higher percentage than any of the major Seattle area rescues I examined.

Homeward Pet Adoption Center had the next highest percentage of average CEO salary to average organizational revenue at only 4.5%.

Ginger’s Pet Rescue paid Ms. Luke more than 3 times that percentage even though Homeward Pets averaged more than twice as much revenue.

Even more astonishing is the percentage of revenue Ginger’s Pet Rescue paid Ms. Luke compared to the percentage the Seattle Humane Society paid its CEO.

Ms. Luke made $151,057, which was 15.7% of the rescue’s average revenue. Seattle Humane’s CEO made $162,297, which was only 1.3% of its average revenue.

Another way to look at it is that for every dollar in revenue contributed to Ginger’s Pet Rescue, more than 15 cents went to Ms. Luke’s salary; only about a penny of each dollar raised by the Seattle Humane Society went to its CEO’s salary.

And although Seattle Humane’s average revenue was more than 12 times higher than that of Ginger’s Pet Rescue ($12.4 million vs. $970,933), Ms. Luke’s average salary was almost the same as that of Seattle Humane’s CEO ($151,057 vs. $162,197).

Any way you compare the numbers, Ginger’s Pet Rescue paid its CEO a significantly higher percentage of its average revenue in 2019-2020 compared to much larger pet rescues in the Seattle area.

Incomplete Tax Forms

The IRS is the federal agency that determines whether or not an organization can be classified as a 501(c)(3) charity. Charitable organizations are exempt from paying taxes and contributions to them are tax deductible.

The IRS has no specific rules regarding how much a charity can pay its CEO; however, its Compliance Guide for 501(c)(3) Public Charities states that:

“A public charity is prohibited from allowing more than an insubstantial accrual of private benefit to individuals or organizations. This restriction is to ensure that a tax-exempt organization serves a public interest, not a private one. If a private benefit is more than incidental, it could jeopardize the organization’s tax-exempt status.”

The guide goes on to say specifically that no part of an organization’s net earnings “may inure to the benefit of an insider.” It defines an insider as “a person who has a personal or private interest in the activities of the organization such as an officer, director, or a key employee.”

So according to the IRS, Ms. Luke was an insider at the time of the excess salary payments because she was an officer, a director, and a key employee.

The IRS notes that an example of a prohibited inurement includes “payment of unreasonable compensation to an insider.”

Because of the dramatic increase in Ms. Luke’s salary in 2019 and 2020, and because the percentage of her salary compared to the rescue’s revenue was 3-12 times higher than that of other CEOs who ran organizations much larger than Ginger’s Pet Rescue, I believe Ms. Luke’s salary during that period was a prohibited inurement as defined by the IRS.

No Explanation for Salary Increase

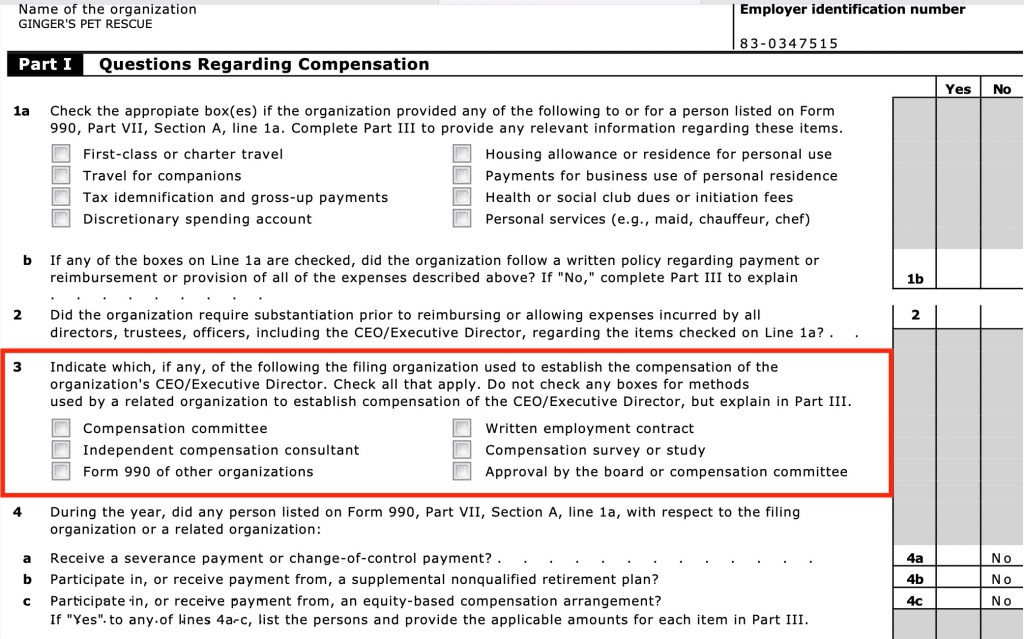

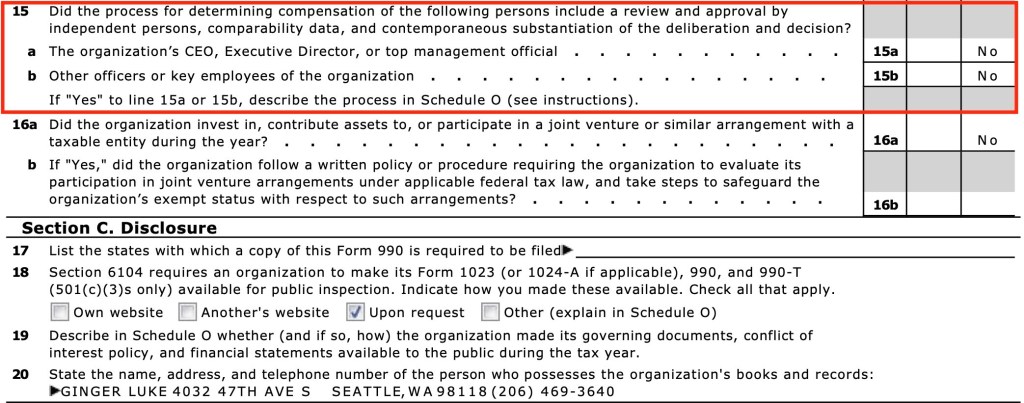

In addition to paying unreasonable compensation to an insider, Ginger’s Pet Rescue failed to acknowledge paying that compensation to Ms. Luke on its Form 990s sent to the IRS.

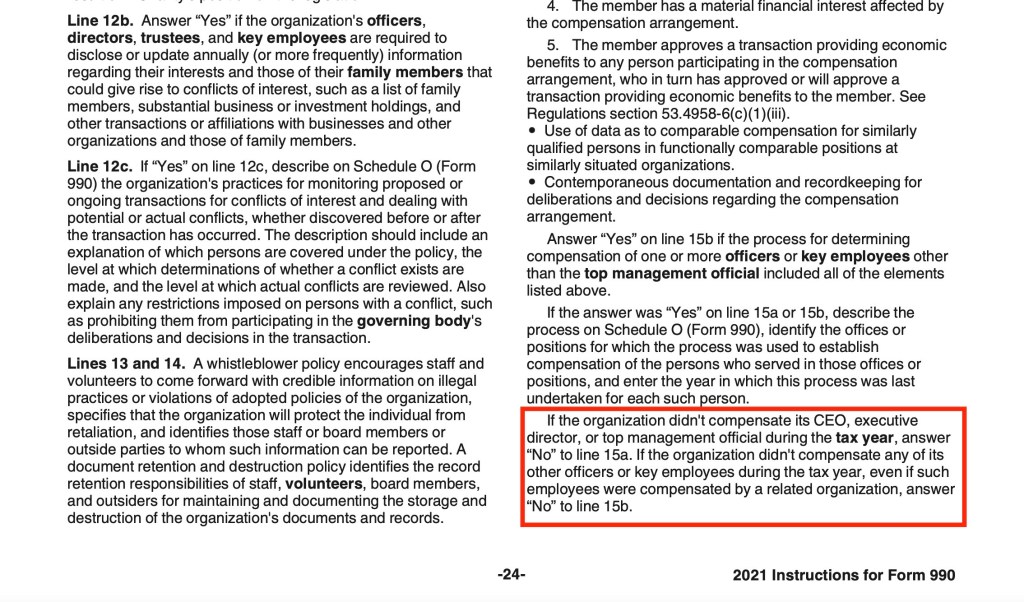

The instructions for Part VI, Section B, Line 15 of the IRS Form 990 state that if an organization “didn’t compensate its CEO, executive director, or top management official during the tax year, answer “No” to line 15a.”

On its tax forms for 2019 and 2020, the rescue checked the “no” box. This told the IRS that it didn’t compensate Ginger Luke even though it noted in another section of the forms that it paid her over $300,000 during that period.

The IRS requires charities that do pay their CEO, Executive Director, or top management official provide documentation showing that “the process for determining compensation…that included the following elements”:

• Review and approval by a governing body or compensation committee, provided that persons with a conflict of interest regarding the compensation arrangement at issue weren’t involved.

• Use of data as to comparable compensation for similarly qualified persons in functionally comparable positions at similarly situated organizations.

• Contemporaneous documentation and recordkeeping for deliberations and decisions regarding the compensation arrangement.

The rescue’s tax forms indicated it had no process for determining and approving Ginger Luke’s compensation during that time period.

The IRS wants charities to show how they determine CEO’s salaries to ensure that a tax-exempt organization serves a public interest, not a private one.

If a charity provides an excessive private benefit, it could jeopardize the organization’s tax-exempt status.

Paying a CEO an excessive salary does not serve the public interest because it takes money away whatever an organization does to serve the public.

Ginger’s Pet Rescue’s stated mission is “to give homeless animals with no hope the life they deserve through rescue, foster, and adoption.”

The excessive salary the rescue paid Ginger Luke meant it had fewer funds to achieve this mission.

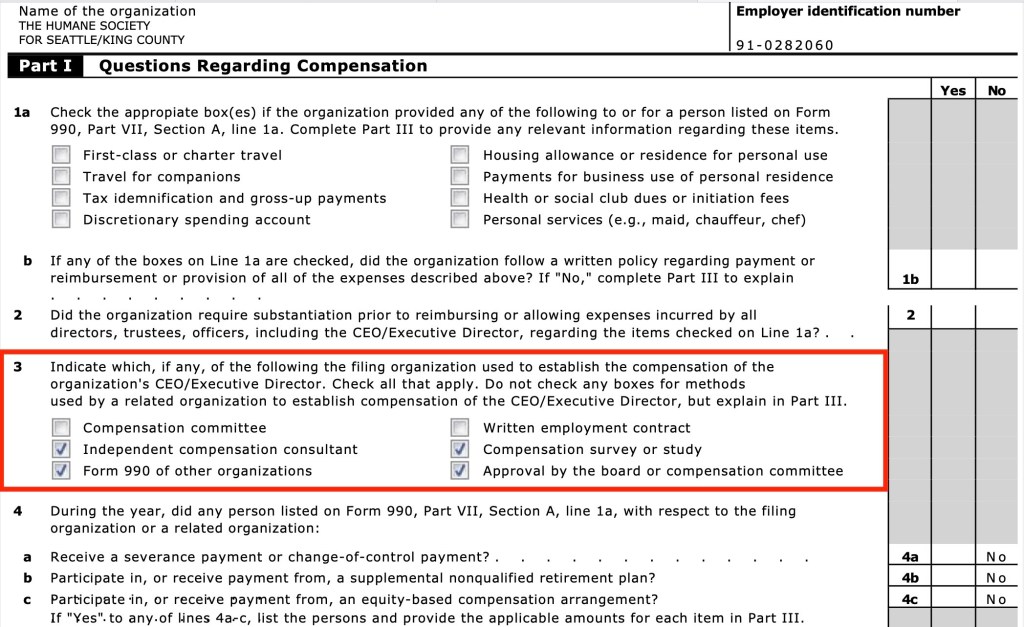

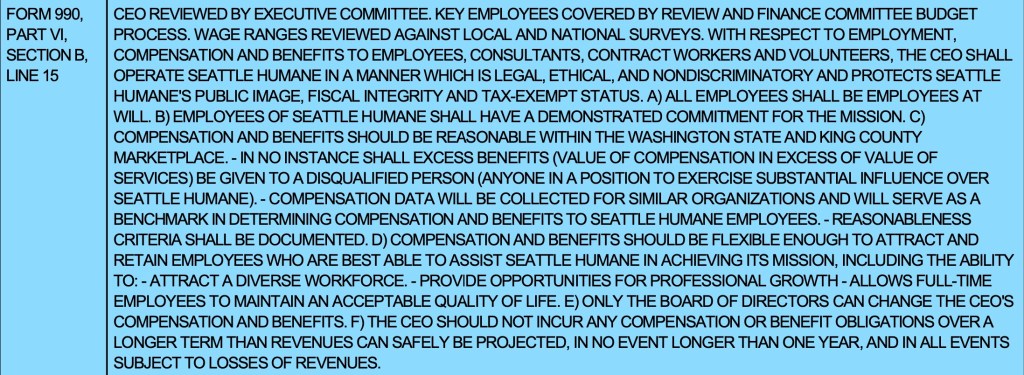

The Seattle Humane Society’s tax forms show how charities should report and justify their CEO’s salary.

Ginger’s Pet Rescue Won’t Answer My Question About Salary Increase

Ginger’s Pet Rescue’s lack of transparency regarding the money it paid to Ms. Luke isn’t just limited to the tax forms it sent to the IRS.

When I first noticed the huge salary increases the organization paid to Ms. Luke I asked why it paid her so much in 2019 and 2020. I also asked who took her place and how much they made.

Here’s the entire conversation I had with someone from the rescue on Facebook:

11/11/21, 7:58 am

You sent

Hi – This is Robert Pregulman from Seattle DogSpot. First, I’m so sorry that Ginger passed away earlier this year. Please accept my condolences for your loss.

You sent

I’m contacting you because I noticed on your 990s that you sent to the IRS that Ginger was paid $138,312 in salary for 2019 and $163,801 in 2020. That was significantly higher than she was paid in past years. It’s also much higher than the salary of directors of much larger animal rescues. Can you please tell me why you paid her so much during 2019 and 2020? Also, can you tell me who took her place and how much they make? Thank you.

11/11/21, 5:55 pm

Ginger’s Pet Rescue

I’m not sure why this concerns you ?

Ginger’s Pet Rescue

It’s also much lower than lots of animal rescues . I’m not sure why it’s a problem who gets paid what ? Do you have any idea the commitment level and how many hours and days a week it takes to run GPR and also the sacrifices rescuers make

11/12/21, 7:16 am

You sent

I do understand the level of commitment it take to run a rescue but I think it’s fair question to ask what prompted the decision to raise her salary by over $100k. And her salary is more than director’s at other rescues that raise more money. Also, no other rescue pays their directors a salary that is such a large percentage of their budget.

You sent

Can you tell me what prompter the organization to give her such a large salary increase?

You sent

prompted

11/16/21, 9:54 am

You sent

Could someone from the board contact me to explain the dramatic salary increase for Ginger for the last years?

11/19/21, 10:04 am

You sent

Just wanted to check again to see if someone from the board could contact me about the salary increase.

Whomever responded to my questions basically told me the reason for the massive salary increase was none of my business. He/she wouldn’t tell me who replaced Ginger and how much they made either.

I repeated my request 3 more times over the next few days but received no other response.

Charities Must Be Transparent to IRS and the Public

Ginger’s Pet Rescue may have had a perfectly justifiable and defendable reason for Ms. Luke’s large salary increase. But its dismissive response to my question and lack of transparency on its tax forms doesn’t engender confidence in the process (if there was one) it used to approve the increase.

Organizations designated as charities by the IRS don’t have to pay taxes so they have more money available to use for the charitable purposes for which they were created. Also, it’s easier for them to raise money because donor contributions are tax deductible.

In return for these entitlements, none of their earnings may provide an excessive benefit to any employee or board member. They must also explain to the IRS their processes for determining these payments.

This ensures that resources aren’t diverted from an organization’s charitable purposes and into the pocket of an individual.

I’m not saying Ginger’s Pet Rescue did anything illegal by significantly increasing Ms. Luke’s salary. But the rescue does have an obligation to provide documentation to the IRS showing the process it used to justify the increase to ensure it wasn’t a substantial accrual of a private benefit or an unreasonable payment to Ms. Luke.

I will continue to investigate the reason for Ms. Luke’s salary increase and will let you know if I ever get an explanation for it.

Here is all the data I collected regarding CEO Salary, Yearly Revenue, and CEO Salary % of Income for the largest pet rescue groups in the Seattle area.

| GINGER’S PET RESCUE | YEAR | SALARY | INCOME | % of income |

| 2015 | $5,200 | $340,182 | 1.53% | |

| 2016 | $35,600 | $747,598 | 4.76% | |

| 2017 | $18,900 | $684,928 | 2.76% | |

| 2018 | $19,200 | $837,618 | 2.29% | |

| 2019 | $138,312 | $1,064,793 | 12.99% | |

| 2020 | $163,801 | $877,073 | 18.68% | |

| AVG 2019-2020 | $151,057 | $970,933 | 15.56% | |

| YEAR | SALARY | INCOME | % of income | |

| THE NOAH CENTER | 2015 | $91,146 | $1,878,105 | 4.85% |

| 2016 | $87,783 | $1,825,068 | 4.81% | |

| 2017 | $87,782 | $2,044,924 | 4.29% | |

| 2018 | $92,325 | $7,274,953 | 1.27% | |

| 2019 | $92,347 | $2,940,580 | 3.14% | |

| AVG 2015-2019 | $90,277 | $3,192,726 | 2.83% | |

| YEAR | SALARY | INCOME | % of income | |

| SEATTLE HUMANE SOCIETY | 2015 | $137,963 | $11,957,658 | 1.15% |

| 2016 | $159,463 | $17,304,789 | 0.92% | |

| 2017 | $144,225 | $14,462,517 | 1.00% | |

| 2018 | $161,562 | $10,593,622 | 1.53% | |

| 2019 | $175,100 | $10,290,807 | 1.70% | |

| 2020 | $195,468 | $9,801,958 | 1.99% | |

| AVG 2016-2020 | $162,297 | $12,401,892 | 1.31% | |

| HOMEWARD PET ADOPTION CENTER | 2015 | $68,750 | $1,456,954 | 4.72% |

| 2016 | $70,948 | $1,614,993 | 4.39% | |

| 2017 | $94,615 | $1,786,347 | 5.30% | |

| 2018 | $106,438 | $2,552,583 | 4.17% | |

| 2019 | $82,579 | $1,977,475 | 4.18% | |

| AVG 2015-2019 | $88,645 | $1,982,850 | 4.47% | |

| YEAR | SALARY | INCOME | % of income | |

| HUMANE SOCIETY FOR TACOMA/PIERCE | 2015 | $113,323 | $5,187,120 | 2.18% |

| 2016 | $113,149 | 10,734,480 | 1.05% | |

| 2017 | $193,009 | $6,455,325 | 2.99% | |

| 2018 | $115,133 | $5,630,426 | 2.04% | |

| 2019 | $199,275 | $6,212,756 | 3.21% | |

| AVG 2016-2020 | 2020 | $194,437 | $6,874,761 | 2.83% |

| AVG | $163,001 | $7,181,550 | 2.27% |

From a data/statistics standpoint comparing the average of 2019-2020 salaries but not comparing the full 5 year history is a major miss. While I don’t know that it’s the reason, if you look at how underpaid Ginger was for the 3 years prior to the increase and compare the average of the 5 years (which is ~72k) is reasonable to hypothesize the rescue was course correcting.

Or I could have compared her average salary for the last two years and compared it to what larger groups in the area pay their CEOs, which would have shown that her salary was way out of line with them. F

Yes, running rescue is hard and time consuming, but that doesn’t justify such a massive salary increase. And it certainly doesn’t justify paying her almost the same as Seattle Humane’s CEO, who runs an organization that raised more than $12 million a year vs. Ginger’s Pet Rescue, which averaged just under a million dollars a year.

In exchange for not paying taxes and accepting tax deductible contributions, charities have a set of guidelines from the IRS that they must follow. They can’t just suddenly decide to increase a CEO’s pay over 600% without justification.

And if the rescue had a defendable reason for the increase, it shouldn’t refuse to answer questions about it.

Hi, my issue with Ginger’s is how much they charge people to adopt a dog, about $500, or more, which is quite high. They say that it’s because of the spay/neuter costs and vet bills.

When I attended Pima Medical Institute, our surgeon spayed Ginger’s dogs, for free, so that we students could learn surgical assisting. (This was completely supervised by the surgeon or the teachers, btw).

This has always struck me as dishonest.

I paid $1300 to adopt my dog from Gingers Pet rescue. His papers were INCREDIBLY fake – the dog photographed was not him or even the same breed. She did not cover the vet bills required to cure his parasite or skin conditions. But she did pay to have him neutered. It’s very obvious that the whole set up is incredibly unprofessional and sketchy. Hopefully funds can be allocated towards growing the non-profit and not the pocket of the new CEO.

I fostered for several years for GPR ,I always had the same questions.

The board is made of family members, which I didn’t think was fair.

If the prices to adopt a dog when I was fostering was what they are today,I would not have fostered. Their prices are over $1,000.00.